Market Opinion for Trading Week 22 Apr ~ 26 Apr 2013

Have fun trading !~ |

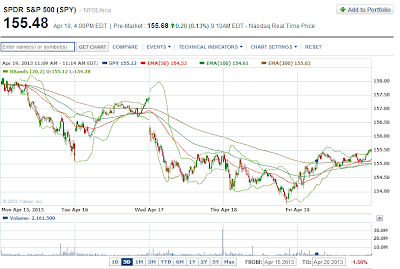

| SPY - 5 days |

Week closed at 155.48. Week open high and close lower. Candles are hovering very near the EMA200. Bears are putting a clear stand on 155.5 mark. Or it could be the short seller covering at the end of the week. Note we are closing off Apr and heading into the month of May.

Accuracy : 5/7

Psychology

Check out the weekly candle stick pattern. What's your feeling of the candle ?

Long lower shadow closing the week above the previous week's low. Solid long bear candle body which is about 3/4 the size of previous. Clear sign of the bears stomping out to hunt. Guess the bulls are tired after the many weeks of charging up, time for them to take a break. Candles seem to be in consolidation between, 153 to 160 waiting for breakout.

Pattern

There are 2 similar candle pattern from the past 2 year candles.

1) Around Oct 11 which, the following week gap down, closed higher and follow by a retracement.

2) Around Apr 12 which, the following week gap down, closed lower and followed by a retracement of about 40% till earn Jun 12. Will it repeat itself this year around this period ? High probability read on

Earnings started

Reports on S&P from factset

http://www.factset.com/websitefiles/PDFs/earningsinsight/earningsinsight_4.12.13

From Profit Confidential - S&P Corporate Earning very soft Q1 2013

As per last week,

Technical

Resistance at 160 and 155.5

Next support level at 150

No go zone

Anything not higher than 158+5=163 and anything not lower than 153-5=148

Opinion of the Market next week : bearish

|

| SPY - Weekly |

Check out the weekly candle stick pattern. What's your feeling of the candle ?

Long lower shadow closing the week above the previous week's low. Solid long bear candle body which is about 3/4 the size of previous. Clear sign of the bears stomping out to hunt. Guess the bulls are tired after the many weeks of charging up, time for them to take a break. Candles seem to be in consolidation between, 153 to 160 waiting for breakout.

|

| SPY - Weekly with drawing |

Seem like it's bearish harami candle stick pattern. Which is likely to follow by a reversal pattern. Plus it's hitting the Fibonacci retracement level of 161.8%.

Pattern

1) Around Oct 11 which, the following week gap down, closed higher and follow by a retracement.

2) Around Apr 12 which, the following week gap down, closed lower and followed by a retracement of about 40% till earn Jun 12. Will it repeat itself this year around this period ? High probability read on

Earnings started

Reports on S&P from factset

http://www.factset.com/websitefiles/PDFs/earningsinsight/earningsinsight_4.12.13

Earnings Growth: The blended earnings growth rate for Q1 2013 is -0.3%. If the final number is

negative, it will mark the second year-over-year decline in earnings for the index in the past three

quarters.

+ Earnings Revisions: On December 31, the earnings growth rate for Q1 2013 was 2.2%. Nine of the ten

sectors have recorded a decrease in expected earnings growth, led by the Materials, Information

Technology, and Consumer Discretionary sectors.

+ Earnings Guidance: For Q1 2013, 88 companies have issued negative EPS guidance and 22 companies

have issued positive EPS guidance.

From Profit Confidential - S&P Corporate Earning very soft Q1 2013

Philip Morris International Inc. (NYSE/PM), an S&P 500 company in the consumer goods sector, reported disappointing corporate earnings for the first quarter of 2013. The company’s profits fell more than 1.6% from the same period last year. Wall Street analysts were expecting Philip Morris to show corporate earnings of $1.34 per share, but the company only earned $1.28 per share. (Source: MarketWatch, April 18, 2103.)

PepsiCo, Inc. (NYSE/PEP), another major company on the S&P 500, registered first-quarter corporate earnings that were 4.7% lower than the same period last year. (Source: Reuters, April 18, 2013.)

UnitedHealth Group Incorporated (NYSE/UNH), the largest health insurer in the U.S. and a constituent of the S&P 500, reported that corporate earnings fell in its first quarter due to rising medical and operating costs. UnitedHealth earned $1.16 per share—11.4% lower than last year’s first quarter, when corporate earnings were $1.31 per share. (Source: Reuters, April 18, 2013.)

Similarly, Nucor Corporation (NYSE/NUE), a steel producer on the S&P 500, reported a drop in corporate earnings of 39% in the first quarter of 2013. The company only earned $0.28 per share compared to $0.46 in the same quarter of 2012. (Source: CNBC, April 18, 2013.)http://www.profitconfidential.com/michaels-personal-notes/corporate-earnings-for-sp-500-companies-very-soft-for-first-quarter-of-2013/

As per last week,

After seeing this, here comes the question, if I m the big boys what would I do to make money ? Its time to cash out anticipating the sell in may. Plus shorting companies that aren't up to performance $ KaChing $

Technical

Next support level at 150

No go zone

Anything not higher than 158+5=163 and anything not lower than 153-5=148

Opinion of the Market next week : bearish

No comments:

Post a Comment