Market Opinion for Trading Week 26 Aug ~ 24 Aug 2013

Have fun trading !~ |

| SPY - 5 Days |

Week closed at 166.62 up from previous week of 165.83

VIX hit 16.

Accuracy : 11/22

Earnings

Earnings highlights this week :

Tiffany & Co. (NYSE: TIF)

Campbell Soup (NYSE: CPB)

Salesforce.com (NYSE: CRM)

Brown-Forman (NYSE: BF-B)

Joy Global (NYSE: JOY)

Sanderson Farms (NASDAQ: SAFM)

Technical

Zone Probability

Range : 163.7 to 170.60

Psychology

Check out the weekly candle stick pattern. What's your feeling of the candle ?

Bulls pushing back to hold the price or short seller covering. Bears are taking a short breather.

Pattern

Season and Cycle

Scenario

If you're the big boys, what would you do to make more profit !

Volumes are dropping. Probably more sitting on the sideline watching.

Opinion of the Market next week : sideways with little upside

Market

167 will be a strong resistance base on the price volume. If it manage to break above and stay above 167. It should attract more bulls.

Commodities

Sectors

|

| 9 Sectors - 3 Months |

|

| 9 Sectors - Weekly |

Currency

Bonds

NYSE Volume

Weekly volume much lower than average.

Economic Data

Not much on Jackson hole meeting.

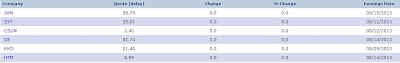

Earnings highlights this week :

Tiffany & Co. (NYSE: TIF)

Campbell Soup (NYSE: CPB)

Salesforce.com (NYSE: CRM)

Brown-Forman (NYSE: BF-B)

Joy Global (NYSE: JOY)

Sanderson Farms (NASDAQ: SAFM)

Technical

ATR : 1.34 from 1.3 last week

Avg Volume : 128.97M from 132.75M

Volume : 79,197,200

Volume : 79,197,200

Range : 163.7 to 170.60

Check out the weekly candle stick pattern. What's your feeling of the candle ?

Bulls pushing back to hold the price or short seller covering. Bears are taking a short breather.

Pattern

Season and Cycle

Scenario

If you're the big boys, what would you do to make more profit !

Volumes are dropping. Probably more sitting on the sideline watching.

Opinion of the Market next week : sideways with little upside