Tuesday 26 July, 2011 - AMC

Tuesday 26 July, 2011 Economic Data

Tue Jul 26 | 9:00am | USD | S&P/CS Composite-20 HPI y/y | -4.5% | -4.6% | -4.2%  | |||

| 10:00am | USD | CB Consumer Confidence | 59.5 | 57.1 | 57.6  | ||||

| 10:00am | USD | New Home Sales | 312K | 321K | 315K  | ||||

| 10:00am | USD | Richmond Manufacturing Index | -1 | 5 | 3 |

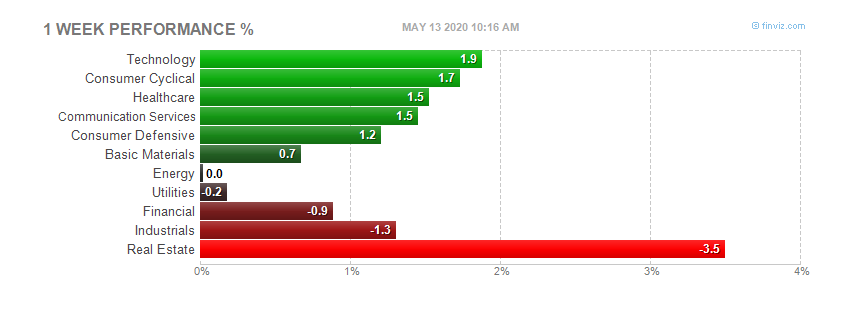

Sectors Performance

What move the market

New Home Sales decline 1.0% MoM

Consumer Confidence prints 59.5, tops estimates

Read more: http://briefing.com/investor/markets/stock-market-update/#ixzz1THou6QJ1

Commodities

Treasury Yield

Notable Earnings

| Macau, Singapore boost Las Vegas Sands CHICAGO (MarketWatch) -- Las Vegas Sands said Tuesday that it swung back to profit in the second quarter, boosted by torrid growth in Macau and Singapore, along with a rebound in Las Vegas. Sands earned $368 million, or 45 cents a share, on the period, vs. a loss of $5 million, or a penny a share in the same quarter of 2010. On an adjusted basis, the company would have earned 54 cents a share, up from 17 cents. Revenue soared 47% to a record $2.35 billion. The average estimate of analysts polled by FactSet Research had been for the company to earn 44 cents a share on revenue of $2.21 billion. Shares of Sands (LVS: news, chart, profile) were up about 3% in after-hours trading. | |

Electronic Arts' earnings rise to $221 million SAN FRANCISCO (MarketWatch) -- Electronic Arts Inc. (ERTS: news, chart, profile) on Tuesday reported a fiscal first-quarter profit of $221 million, or 66 cents a share, on total revenue of $999 million. During the same period a year ago, EA earned $96 million, or 29 cents a share, on revenue of $815 million. Excluding one-time items and deferred revenue from certain video game titles, EA would have lost $123 million, or 37 cents a share on sales of $524 million. By that measure, analysts surveyed by FactSet Research had forecast EA to lose 40 cents a share on revenue of $508.6 million. For its fiscal second-quarter, EA said it expects to lose between 3 cents and 13 cents a share, excluding one-time items, on revenue in a range of $925 million to $975 million. Analysts had earlier forecast EA to lose 4 cents a share on $902 million in sales. | |

Amazon earnings fall as spending jumps SAN FRANCISCO (MarketWatch) - Amazon.com reported a decline in earnings for the second quarter despite strong revenue growth, as operating expenses jumped from the company's continued investments in its infrastructure and development of new products. For the quarter ended June 30, Amazon (AMZN: news, chart, profile) reported net income of $191 million, or 41 cents a share, compared with net income of $207 million, or 45 cents a share, for the same period last year. Revenue jumped 51% to $9.91 billion. Analysts were expecting earnings of 35 cents a share on revenue of $9.37 billion for the period, according to consensus estimates from Thomson Reuters. Amazon said it expects revenue to come in the range of $10.3 billion to $11.1 billion for the third quarter. Analysts had been expecting revenue of $10.35 billion for the period. | |

LVMH profit soars on revenue, share gains CHICAGO (MarketWatch) -- LVMH Moet Hennessy Louis Vuitton said Tuesday that its revenue hit a record 10.3 billion euros ($14.9 billion) in the first half of the year, an increase of 13%, while profit from continuing operations spiked 22% to 2.2 billion euros ($3.19 billion). All of the company's business units were up, LVMH (LVMHF: news, chart, profile) said, and all of its brands made market- share gains. "We approach the second half of the year with confidence and are relying upon the creativity and quality of our products as well as the effectiveness of our teams to pursue further market share gains in our historical markets as well as in high potential emerging markets," said Bernard Arnault, chief executive, in the earnings report. |

Baidu shares jump 5%; earnings rise 95%  (9:45 am ET)

(9:45 am ET)

NEW YORK (MarketWatch) -- Baidu Inc. (BIDU: news, chart, profile) shares rose 5% Tuesday at the market's open, after posting a 95% jump in second-quarter earnings the previous day. On Monday evening, the Chinese search engine reported earnings of RMB 1.6 billion ($252.6 million), or RMB 4.67 (72 cents) a share. Second-quarter revenue was RMB 3.4 billion ($528.4 million), up 78% from the year-ago period. Chinese Internet stocks have invited a flurry of investor interest recently. U.S. listed shares of Baidu have been up 70% this year.

NEW YORK (MarketWatch) -- Baidu Inc. (BIDU: news, chart, profile) shares rose 5% Tuesday at the market's open, after posting a 95% jump in second-quarter earnings the previous day. On Monday evening, the Chinese search engine reported earnings of RMB 1.6 billion ($252.6 million), or RMB 4.67 (72 cents) a share. Second-quarter revenue was RMB 3.4 billion ($528.4 million), up 78% from the year-ago period. Chinese Internet stocks have invited a flurry of investor interest recently. U.S. listed shares of Baidu have been up 70% this year.

DreamWorks Animation profit climbs 42%  (4:56 pm ET)

(4:56 pm ET)

CHICAGO (MarketWatch) -- DreamWorks Animation SKG Inc. (DWA: news, chart, profile) shares were up 4% in after-hours trading Tuesday after it reported a 42% increase in second-quarter profit on better-than-expected revenue, propelled by the worldwide box office performance of "Kung Fu Panda 2." The company said it earned $34.1 million, or 40 cents a share, compared with a profit of $24 million, or 27 cents a share, in the same quarter a year ago. Revenue rose to $218.3 million from $158.1 million. Analysts polled by FactSet Research were expecting a profit of 41 cents a share on sales of $191.3 million. DreamWorks Animation said third quarter results are expected to be driven by the continued international box office performance of the "Kung Fu Panda" sequel, along with domestic pay television revenue from "Megamind."

CHICAGO (MarketWatch) -- DreamWorks Animation SKG Inc. (DWA: news, chart, profile) shares were up 4% in after-hours trading Tuesday after it reported a 42% increase in second-quarter profit on better-than-expected revenue, propelled by the worldwide box office performance of "Kung Fu Panda 2." The company said it earned $34.1 million, or 40 cents a share, compared with a profit of $24 million, or 27 cents a share, in the same quarter a year ago. Revenue rose to $218.3 million from $158.1 million. Analysts polled by FactSet Research were expecting a profit of 41 cents a share on sales of $191.3 million. DreamWorks Animation said third quarter results are expected to be driven by the continued international box office performance of the "Kung Fu Panda" sequel, along with domestic pay television revenue from "Megamind."

Technical Updates

- Formed double top

- Nicely at support of PHI fan

- very bearish candle no shadow

- Possibility of heading 61.8% Fibonacci support

Wednesday 27 July, 2011 BMO

Wednesday 27 July, 2011 Economic Data

Wed Jul 27 |  8:30am 8:30am | USD | Core Durable Goods Orders m/m | 0.5% | 0.7%  | ||||

8:30am 8:30am | USD | Durable Goods Orders m/m | 0.4% | 2.1%  | |||||

| 10:30am | USD | Crude Oil Inventories | -1.2M | -3.7M | |||||

| 2:00pm | USD | Beige Book |

News

- Growing numbers of consumers are expecting more jobs and increased income in coming months, the Conference Board said Tuesday as it reported that its consumer-confidence index rose in July

- Soros’s decision protects money, legacy, influence - Soros to wind down hedge-fund operation

- House Speaker John Boehner is rewriting his bill to lift the debt ceiling and cut spending after the Congressional Budget Office ruled his plan would have only cut spending by $850 billion over 10 years rather than the $1.2 trillion the Republican sought. The House may end up voting on the bill on Thursday rather than the initially scheduled Wednesday vote

- Calif. raises $5.4 billion in case D.C. messes up

- Gold Future 1623 pts

Earnings

Mouseover symbol for more detail

Wednesday

Chart displays significant changes from previous EPS vs. expected EPS estimates

| 27. JUL. 2011 Today´s Highlighted Earnings Releases | |||

| COMPANY | EVENT TITLE | EPS ESTIMATE | EPS ACTUAL | PREV. YEAR ACTUAL | |||

| Boeing Co | Q2 2011 Boeing Co Earnings Release | $ 0.97 | n/a | $ 1.06 | |||

| Symantec Corp | Q1 2012 Symantec Corporation Earnings Release | $ 0.37 | n/a | $ 0.35 | |||

| Citrix Systems Inc | Q2 2011 Citrix Systems Inc Earnings Release | $ 0.55 | n/a | $ 0.41 | |||

| Northrop Grumman Corp | Q2 2011 Northrop Grumman Corp Earnings Release | $ 1.68 | n/a | $ 2.34 | |||

| General Dynamics Corp | Q2 2011 General Dynamics Earnings Release | $ 1.72 | n/a | $ 1.68 | |||

| Dow Chemical Co | Q2 2011 The Dow Chemical Company Earnings Release | $ 0.79 | n/a | $ 0.54 |

Almanac

Summary

- US debt still not much progress, probably gonna drag till the final hours of 2 Aug

- A couple of DOW components annoucing earnings today, BA bearish EPS and GD bullish EPS probably have a significant impact on today's market sentiments

Market Direction : Down

Accuracy : (9/14)

- Current economic situations around the world

- Soaring prices in almost everything except our salary

- Easily available credit leverage (I m sure i m not the only one that receive calls from banks promoting their easy cash, some even send in blank cheque for me to have cash advancement)

No comments:

Post a Comment